Posts Tagged ‘natural gas extraction’

Pennsylvania Budget passes without a Marcellus tax or fee

Both the Senate and the House have passed a budget that fails to tax or charge any type of fee on Natural Gas extraction from the Marcellus Shale.

The issue of taxing of Marcellus Shale has been a major topic of discussion, especially in Northeastern Pennsylvania. The impact of the extraction of Natural Gas from the Marcellus Shale has made some people very wealthy and others very upset.

Pennsylvania is the only major natural gas producing state that currently has no tax or extraction fee on natural gas. Governor Tom Corbett campaigned on a platform of no taxes on Marcellus shale and has stuck to that campaign promise in his proposed budget, and the legislature follows suit.

A Quinnipiac poll in June 2011, showed that those polled support, 69 percent to 24 percent, a new tax on companies drilling for natural gas. Even 69 percent of Republicans polled support such a tax.

State Senator John Yudichak (D-14th) says the issue is not dead, and that the legislature will address the issue of Marcellus tax or fees this Fall.

Yudichak, a strong voice for a Marcellus Shale Impact Fee or Severance Tax, also stated that he is disappointed the legislature failed to enact a fair and responsible fee on natural gas drilling, which would have significantly helped address adverse environmental issues associated will drilling.

This is only the third time in more than 40 years that a Pennsylvania State Budget spends less than the previous years. A major factor in the reduction in spending is the loss of federal stimulus money, which allowed Pennsylvania and many other states to save programs and jobs over the past two years. That money is no longer available.

Yudichak, who joined his Democratic colleagues in solidarity in voting against the budget, was not pleased with the budget. Yudichak says the plan falls short of preserving programs and services vital to Pennsylvania’s economic recovery.

On the $27.15 billion spending plan, Yudichak stated that the spending plan cuts too deeply into education and job creation programs, weakens the hospital system and fails to enact a responsible fee on Marcellus Shale drilling.

“For months, I have called for guiding this budget by two principles – job creation and making government more accountable to taxpayers,” Yudichak said. “Unfortunately this budget falls severely short of these principles.”

Yudichak said school districts in the region will face a severe cut of $23,687,669 in this budget. On average that is a 13.3 percent cut from 2010-2011. He added that these districts will now have to cut vital educational programs and layoff teachers, students will be crowded into classrooms and households will inevitably see a spike in property taxes.

Northeastern Pennsylvania school districts will see significant reductions in state revenues. The decrease in funding from 2010 to 2011 is as follows:

· Nanticoke – $1,580,628 less – 13% cut

· Hanover Area- $1,048,569 less – 13% cut

· Hazleton Area – $4,516,132 less – 12% cut

· Pittston Area – $1,260,312 less – 12% cut

· Wilkes-Barre Area – $3,904,811 – less 14% cut

· Wyoming Area – $986,676 less – 12% cut

· Wyoming Valley West – $2,922,455 less – 14% cut

· Pocono Mountain – $4,182,942 less – 17% cut

· Jim Thorpe – $503,404 less – 16% cut

· Lehighton – $1,196,384 less – 13% cut

· Panther Valley – $1,234,349 less – 14% cut

· Weatherly – $351,007 less – 10% cut

Yudichak added that colleges and universities throughout the state will receive significantly less funding in this year’s budget.

“We have some very worthy institutions in our region. Unfortunately, our community colleges, our private colleges and universities, our state system schools and our state- related colleges will see their funding decrease, their tuition increase and the dream of higher education for many students will remain just a dream,” Yudichak said.

He added that cuts to job creation and business support programs in the state Department of Economic Development will harm efforts to rebuild Pennsylvania’s economy.

“It seems awfully misguided to cut proven job creation initiatives during a time of fiscal distress, yet these initiatives have also been zeroed out in this budget plan,” Yudichak said. “True economic growth comes from solid programs that help businesses get off the ground and maintain their workforce.”

Yudichak added that despite modest restorations made to uncompensated care, in the amount of $16.5 million, hospitals are still negatively affected by budget cuts.

“These restorations are a good start, but hospitals really need more funding,” Yudichak said. “And, with adultBasic not being funded in this budget, more and more individuals will turn to hospitals for care.”

“Here and now we have bipartisan support on a fair impact fee that would protect the environment as well as continue to grow the tremendous economic impact of the Marcellus Shale industry, yet it remains unfinished business,” Yudichak said. “The people of Pennsylvania, by an overwhelming majority, have called for a fair and responsible tax or fee on natural gas drilling in the Marcellus Shale region.”

Yudichak finished by saying that while he understands the seriousness of Pennsylvania fragile economy, there were other option available to stem the harsh cuts made in this spending plan.

“I truly understand that with fiscal distress comes the need for a bit of belt tightening, but what I do not understand is why we are selling short the future of Pennsylvania with a budget that weakens job growth and fails to enact a responsible Marcellus Shale severance tax.”

- Get the best political coverage in NEPA at the Examiner. Please click on the “subscribe” icon above to receive email alerts on NEPA politics articles. Your email address will not be shared with third parties.

- Tell your friends, family, and co-workers. We are remaking the way you get your local political news. Follow and hear from your elected officials and favorite candidates without a filter.

Posted At: Examiner.com

What They’re Saying: MSC on the Road, Shale Gas Industry Continues to Bring Hope to Rural Communities

It’s been another busy, fact-packed, job-creating week for the Marcellus Shale Coalition(MSC). From meetings with Luzerne County landowners, to a grand opening of aWestmoreland County facility, the MSC continues to engage and help educate key stakeholders, various coalitions, small businesses and folks just looking for an opportunity to join our industry’s efforts in delivering affordable, clean-burning energy for America — a key aspect of our ‘Guiding Principles’.

Here’s what they’re saying about the economic activity that responsible Marcellus development is providing for the region’s workforce and small businesses.

- “Now there is an opportunity and plenty of work that will be here for a long time”: “More than 100 local business people turned out to see how they can take advantage of the touted economic boom from Marcellus Shale natural gas extraction. Businesses ranging from engineering and restaurants to jewelers and electricians came to the Hilton Scranton and Conference Center to see what the new industry needs and whether they can provide it. The dollar amounts are eye-popping. A single well costs $4 million to complete. It requires 125 tons of cement, 5,000 tons of aggregate stone and 180 rail cars of sand. A Range Resources executive said more than 100 suppliers and contractors are needed to complete a well. Every mile of pipeline is another $1 million. … “We are an example of a local company that got involved in the play,” he said. “I came back to the area for this, and we all complain that our kids can’t come back. Now there is an opportunity and plenty of work that will be here for a long time.” (Scranton Times-Tribune, 10/22/10)

- Local Business Hires 20, Opens Two New Offices for Marcellus-Related Work: “The Marcellus Shale offers tremendous economic opportunity for local small business owners, representatives of the Marcellus Shale Coalition said Thursday. … At a meeting with local business leaders … representatives from the natural gas drilling and pipeline industries offered advice on how to tap the well of opportunity offered by the shale gas industry.About 100 people attended the event, which was co-hosted by gas-industry advocacy group Marcellus Shale Coalition, the state Department of Community and Economic Development, the Northeastern Pennsylvania Industrial Resource Center and the Greater Scranton Chamber of Commerce. Chris McCue, of Borton-Lawson, called his Wilkes-Barre-based environmental engineering firm a “story of a local company that’s been able to get involved in the (Marcellus Shale) play that didn’t have experience prior to the play developing.” McCue said development of the Marcellus Shale has given Borton-Lawson “a resume that we didn’t have a year and a half ago and helped the firm hire 35 employees since January, 20 of them directly linked to the drilling industry, and open branch offices in Towanda and Pittsburgh. (Wilkes-Barre Time Leader, 10/22/10)

- MSC president “sees 90,000 new Pa. jobs by end of year”: Promising thousands of jobs and decades of development, a natural gas drilling advocacy group says the change the industry will bring to Pennsylvania has only just begun. “I think it has happened quickly, but I think the coverage of it has been pervasive. I mean the interest in it has made it seem faster than it really is,” Marcellus Shale Coalition President Kathryn Klaber told The Times Leader on Wednesday. Natural gas drilling in the Marcellus Shale is not a “flash-in-the-pan gold rush,” Klaber said, but an industry that will add 90,000 jobs to Pennsylvania’s work force by the end of the year and will produce steady employment for decades to come.” (Wilkes-Barre Time Leader, 10/21/10)

- “Marcellus Shale natural gas can give Pennsylvania energy security”: “Pennsylvania is facing a ‘huge opportunity’ with the development of the Marcellus Shale, but it also faces many more challenges in the coming year on several economic fronts, a state Chamber of Business and Industry executive believes. Gene Barr, vice president of Government and Public Affairs for the Pennsylvania Chamber of Business and Industry, was the keynote speaker at last night’s annual meeting of the Clinton County Economic Partnership. … “This area, along with the rest of the state where the Marcellus is, has the opportunity to see the biggest economic boom that Pennsylvania has seen in decades,” he said. … Marcellus Shale natural gas can give Pennsylvania energy security at a time when the state is now a huge exporter with of coal and nuclear power, he said. (Lock Haven Express, 10/14/10)

- More Marcellus Jobs en route to Tioga Co.: “Ground was broken Thursday for a treatment plant that will allow wastewater produced by hydrofracturing for natural gas in the Marcellus Shale in Tioga County to be treated and reused “indefinitely,” according to Neil Hedrick, Hydro Recovery LP president. … Hydro Recovery LP is expected to begin operations in April, Hedrick said, and will employ 12 people. It also will create about 40 construction jobs while it is being built. Mike Hawbaker, owner of Hawbaker Engineering, is the plant’s designer. Since drilling began in the Marcellus Shale more than two years ago, his company has been able to add 200 jobs, he said. Hedrick said the facility is the first of about 12 the company plans to build in the region. (Williamsport Sun-Gazette,10/22/10)

- Chamber of Commerce Exec.: Marcellus Producers “are hiring local”: “Companies doing business in the Marcellus Shale are moving to the area and creating jobs for local workers. About 1,000 of the jobs were available at Saturday’s Marcellus Career Expo at the Pennsylvania College of Technology field house. … According to an event program, companies were looking for, among other things, receptionists, sales staff, crane and heavy equipment operators, commercial drivers, general laborers, mechanics, drillers, derrick-hands, and engineers. “There are definitely local jobs available,” said Chamber of Commerce Executive Vice President Jason Fink. “There are a lot of folks saying people are being brought in from out of state for these jobs. That’s not what we’re seeing from these companies. They are hiring local.” … Mark Farabee, district manager for Halliburton… said his company is expanding and anticipates hiring 300 people by the end of next year. … “The majority are local,” Morris said, adding, “We’re always looking to hire employees. I just hired 12 people within the last three or four days.” (Williamsport Sun-Gazette, 10/17/10)

- Marcellus Jobs “reality, in some cases, is different from the talking points of the industry’s detractors”: “There were 20 companies there. They were offering about 1,000 jobs. They intend to hire local people. That was the format at Saturday’s Marcellus Career Expo at the Pennsylvania College of Technology. Besides offering opportunity, the expo offered a window into the reality of employment by the gas industry. That reality, in some cases, is different from the talking points of the industry’s detractors. … These companies do hire local people and will be hiring more of them … While many of those hired may start out relatively low on the wage scale, they can make a lot of money within a couple years, perhaps in the $60,000 to $100,000 range. (Williamsport Sun-Gazette Editorial, 10/22/10)

- Working Together, Educating the Community, Hiring Locally: “A gas industry engineer stressed the importance of working together to ensure Wayne County can get the most out of the Marcellus Shale at a Tuesday evening educational forum on natural gas drilling. The Wayne County Oil & Gas Task Force and the Penn State University Cooperative Extension sponsored “Marcellus Well Drilling 101” at the Honesdale High School. … He said Marcellus Shale in the county would bring opportunities to everyone. … He also said the process is so broad and complex that it would be impossible to not involve local workers. “We have to work together. I’m not able to transport a bunch of workers from Oklahoma,” he said. (Wayne Independent, 10/20/10)

- Baker Hughes hiring for center: “Baker Hughes Inc., an oil and natural gas services company based in Houston, said Thursday it is hiring an unspecified number of skilled laborers for its new $16 million repair and maintenance center in Hempfield, Westmoreland County. The 57,000-square-foot facility will support natural gas drilling and production in the Marcellus shale reserves in Pennsylvania and West Virginia, said spokeswoman Kathy Shirley. About 75 people so far work at the Hempfield center, part of a $250 million investment Baker Hughes is making to support its Marcellus operations, the company said. (Tribune-Review, 10/22/10)

Copyright http://marcelluscoalition.org/

Competitive Tax Structure Imperative to Keep PA’s Economy, Workforce Ahead of Curve

As State House Readies Massive New Tax on Shale Gas Job Creators, Leaders Must Consider Host of Unintended Consequences

Canonsburg, Pa. – The responsible development of the Marcellus Shale’s clean-burning, homegrown natural gas reserves represents a historic opportunity to revitalize Pennsylvania’s economy by growing its workforce, all while strengthening our nation’s energy security and improving its environment.

In fact, the Reading Eagle took a deep look at these economic, environmental and national security benefits in a weekend story under the headline “Pennsylvania gas reserve could transform U.S. energy market.” But commonsense laws, policies and regulations that encourage this tightly-regulated, environmentally proven production are key to maximizing these benefits for each and every Pennsylvanian and ensuring this transformational opportunity is fully realized. And as Marcellus Shale production expands across the Commonwealth, so too do these much-needed, job-creating benefits.

But as the General Assembly’s legislative calendar quickly draws to a close before this fall’s elections, the Associated Press reports that “Pennsylvania’s House majority leader said Friday that he plans to hold a vote next week on legislation to impose a tax on Marcellus Shale natural gas extraction,“ noting that “Todd Eachus, D-Luzerne, said he will press for a minimum tax of 39 cents per thousand cubic feet.”

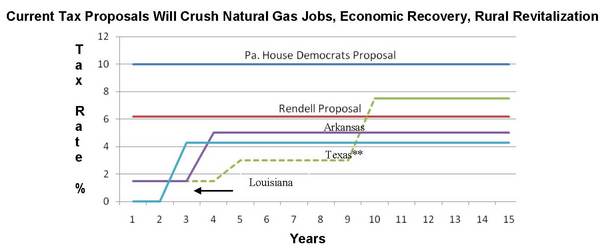

Unfortunately, this proposed new, massive tax – twice as large (and punitive) as West Virginia’s, which is currently the nation’s highest – would drive critical capital investment to other energy-producing states (and countries), dramatically undercutting efforts that are helping to lower energy costs for Pennsylvania consumers and creating jobs at a time when they’re most needed. Here’s a look at the taxes on the books in other shale gas-producing states, which are competing fiercely for the jobs and the critical capital investment needed to produce from the Marcellus:

It’s also important to note that the competing shale gas-producing states, including Texas, Arkansas and Louisiana, all include a capital recovery period in their tax structures, reflecting their commitment to attract investment and job creation – not discourage it – like the model under consideration in the House of Representatives.

In yesterday’s Harrisburg Patriot-News, Kathryn Klaber — president and executive director of the Marcellus Shale Coalition (MSC) — underscores how critical it is that our leaders in Harrisburg “get this right” in a column entitled “Misguided Marcellus Shale tax would cost PA”:

|

We have an opportunity to make Pennsylvania a national leader in natural gas production – a “first” that will afford thousands of Pennsylvanians a good-paying job, spur billions in economic development and provide America with the energy security it so desperately needs.

Our lawmakers should reject any massive, new tax proposal that puts Pennsylvania last.

Copyright: Marcelluscoalition.org

Forced into drilling

By Elizabeth Skrapits (Staff Writer)

Published: July 11, 2010

DALLAS TWP. – Mary Alice Frederick became nervous in March when she discovered her neighbor, the Irem Temple Country Club and the Masonic Village development, had leased mineral rights to a natural gas company.

“I can’t put a chicken coop in my backyard but people can put heavy industry all around the township. I don’t understand that,” the retired Dallas school teacher said. “It doesn’t make sense. It doesn’t seem fair.”

A proposal on the table that would allow natural gas companies to take gas from beneath people’s properties regardless of whether or not they have leased their mineral rights, Frederick now fears losing the peace and quiet of her beloved neighborhood.

In exchange for a tax on natural gas extraction, gas companies are seeking what they call “fair pooling,” legislation that would require property owners without leases to allow drilling beneath their land in exchange for a share of royalties to be determined. However, the gas companies could not put a drilling rig on unwilling owners’ properties. Landowners call “forced pooling.”

“Gas companies are just bullying their way in and telling the legislators what they want. It should be the reverse,” Lehman Township resident Joseph Rutchauskas said. “It’s a democracy, not a corporate dictatorship.”

Rutchauskas lives near two sites permitted for natural gas wells. In August, Encana Oil & Gas USA Inc. intends to start preparing one in nearby Lake Township for drilling, and has all the requirements for a well in Lehman Township. Encana recently notified Lehman Township supervisors they do not plan to drill the third well in Lehman Township.

“I do not support that one bit because I feel it’s a violation of my rights,” Rutchauskas said about forced pooling. “I don’t think anyone should have the right to tell me they can drill under my land without my consent.”

He said his development, which has 10 properties, is protected by covenants that do not allow drilling of any kind, including beneath the property.

“We would have to change the covenants to allow it, and nobody in the development wants to do that,” Rutchauskas said.

He said the question of whether the covenants would hold up under a forced pooling law would have to be answered legally.

“I would take it to court to whatever level necessary,” Rutchauskas vowed.

Irem Temple Ancient Arabic Order Nobles Of The Mystic Shrine have leased 355.91 acres to Chesapeake Appalachia, LLC. The land completely surrounds Frederick’s half-acre property.

The concept of forced pooling scares Frederick, who was already concerned about the potential to turn her quiet suburban street into an “industrial zone.” She opposes natural gas drilling because of potential harmful effects on the environment. She also doesn’t like the idea that foreign investors from countries such as United Arab Emirates and China have interests in natural gas companies.

“I don’t want to be part of this,” Frederick said. “I do have a conscience.”

Irem Recorder Harry Wood said the organization has not heard anything from Chesapeake about plans for the site.

“I don’t blame them,” he said in response to residents’ concerns about forced pooling.

However, Wood said gas drilling would be done far enough away from homes that they shouldn’t be affected, even in the case of horizontal drilling.

“Everybody has the wrong idea about that. It would never be allowed on any of these properties. If any drilling would be done it would be on the top of the hill, or away from the residences,” he said.

Developing the Irem Golf Course is also not an option, he said.

“I’m not going to take a $7 million golf course and put a drilling rig in the middle of it,” Wood said.

eskrapits@citizensvoice.com, 570-821-2072

View article here.

Copyright: The Citizens Voice

What They’re Saying: Marcellus Shale “a wonderful thing”; Creating tens of thousands of “family-sustaining jobs”

- “There were a lot of people around here who had a nicer Christmas last year because of the gas busines

- “The greatest economic and clean-energy opportunity of our lifetime

- “This is a good thing for us”

Marcellus Shale creating “family-sustaining jobs”: John Moran Jr., president of Moran Industries, described the arrival of the natural gas industry as “a wonderful thing” that will both create “family-sustaining jobs” and lead people to finally “really believe the clouds (have) parted.” He likened the gas industry to “a blessing from God” and predicted a trickle-down effect and creation of new wealth unlike anything seen here since the long-ago lumber era. Heinz said the gas industry brings to the area “unlimited” business and employment opportunities. (Williamsport Sun-Gazette, 6/23/10)

Responsible Marcellus development benefiting “the mom-and-pops”: “The burst in industrial activity creates new business opportunities and spinoff benefits for established companies, said Marilyn Morgan, president of the Greater Montrose Chamber of Commerce. “We’ve got a lot of entrepreneurs,” she said, including vendors selling food at drilling sites and start-up laundry services cleaning clothes for gas-field workers. “The mom-and-pops are starting to see some economic benefits,” Morgan said. “Restaurants are seeing a difference.” (Towanda Daily-Review, 6/23/10)

Sen. Mary Jo White: Marcellus Shale “the greatest economic, clean-energy opportunity of our lifetime”: “It must be noted that this activity has generated billions of dollars for landowners, including the state, through lease and royalty payments, as well as hundreds of millions of tax dollars through corporate and personal income, sales, fuel and other taxes. … Without question, we must ensure that drilling occurs in a responsible manner. Thanks to increased permitting fees, we now have twice as many permit reviewers and inspectors on the ground than before the Marcellus rush. … The Marcellus Shale presents perhaps the greatest economic and clean-energy opportunity of our lifetime. (Pittsburgh Post-Gazette, 6/23/10)

Marcellus Shale expanding PA’s workforce, small businesses: “According to Heinz, M-I SWACO initially will employ about 20 to 30 people at or working out of the Moran site, but he predicted the numbers will grow. … Among the employment opportunities are skilled positions for field engineers. Those hired locally will be those with both high school and college degrees, who will train before going out to well sites, according to Heinz. (Williamsport Sun-Gazette, 6/23/10)

Congressman Joe Pitts: Marcellus Shale will benefit local companies, “reduce energy costs while improving air quality”: “A Penn State University estimate shows that there is now enough gas in the Marcellus Shale to supply the entire U.S. for more than 14 years. Obviously, the Shale is not going to be tapped all at once and will not be the sole source of gas in the U.S., meaning that wells in Pennsylvania will provide a source of natural for decades. It is estimated that natural gas exploration could lead to more than 100,000 jobs statewide. While Pennsylvania’s 16th Congressional District is not located above the shale,local companies will certainly benefit. … With many Pennsylvanians looking for work we shouldn’t pass up this opportunity to create new jobs. Responsible development of the Marcellus Shale can reduce energy costs while improving air quality. (Pottstown Mercury,6/23/10)

Marcellus Shale generating new jobs, significant revenue for local, regional businesses: “Larry Mostoller’s company moves up to 1 million gallons of water a day for Cabot Oil and Gas Corp. “My company has grown 300 percent in one year.” “I employ 80 percent of my workforce from Susquehanna and Wyoming counties,” he said. “I’m definitely going to go over 100 (employees) this year.” Despite controversy about the economic, environmental and employment impacts of Marcellus Shale natural gas development, the industry generates new jobs and significant revenue for regional businesses. … A recent Penn State University study financed by the gas industry concluded that drilling companies spent $4.5 billion in the state in 2009 and helped create 44,000 jobs. (Citizens Voice, 6/23/10)

Marcellus development helping local school districts, “Taxpayers like the idea”: “A school district in Bradford County is now caught up in the natural gas boom. Towanda Area School District agreed Monday night to a $500,000 gas lease with Chesapeake Energy. … “This is added money that we didn’t have before, new money,” said school board vice president Pete Alesky. … There won’t be big gas drilling rigs on the actual school property. The lease only allows the gas company to drill underneath the land. If the gas company finds gas there, then the school district can make more money by getting 20 percent royalties. “They should get in it. The opportunity is there to get some money and they should get it,” said taxpayer Howard Shaw of Wysox Township. … Taxpayers who talked with Newswatch 16 liked the idea of the district getting the surge of cash. (WNEP-TV, 6/22/10)

Marcellus Shale ‘crop’ sustaining family farms: “Natural gas is a new crop for farmers in many parts of the state. It is harvested thousands of feet below the topsoil. This new revenue it generates has allowed countless farms to stay in business, repair and upgrade their barns and buy new equipment to plant their crops. The lease revenue has saved many farms from development and allowed farmers to invest in modern no-till equipment to farm in a more efficient and environmentally friendly way – both are good for water quality and the environment. (Wilkes-Barre Times Leader LTE, 6/22/10)

Marcellus Shale send rail yards booming, boosting “overall economic development”: “A $500,000 upgrade of the historic rail yard in Fell Twp., which was built in 1825 to help ignite the region’s coal boom, is a good example of the region’s new gas industry’s ability to boost overall economic development and of the growing importance of rail freight to the region. The project will make possible the easy delivery, by rail rather than truck alone, of many of the materials used in the booming Marcellus Shale drilling industry. … The rail yard upgrade is a good example of how to use the gas industry to boost general economic activity. (Scranton Times-Tribune Editorial, 6/22/10)

PA prof.: Marcellus “energy, income, jobs a good thing for us”: “Debate about the economic effect may overlook the impact on the ground, said John Sumansky, Ph.D., an economist at Misericordia University in Dallas. “The burst of energy and income and jobs coming from this spills over to a sector where the economy has been lagging in this region,” Sumansky said. “This is a good thing for us, especially in the fields of transportation and construction.” It is a good thing for Latona Trucking and Excavating Inc., a Pittston company that does well-site preparation and hauls water for Chesapeake. On some days, up to 60 of the company’s 120 employs do gas-related work, said Joseph Latona, company vice president. … “This will probably be our best year ever in business.” (Towanda Daily-Review,6/23/10)

200,000 well-paying jobs will be generated over the next decade: “It is likely, with the continued development of the Pennsylvania Marcellus Shale and the aging of the current natural gas industry workforce, that more than 200,000 well-paying jobs will be generated over the next decade, with an even greater number as drilling activity increases. … There is an immediate need for truck drivers/operators, equipment operators, drillers, rig hands, geologists/geophysical staff, production workers, well tenders, engineers, land agents and more. (PA Business Central, 6/22/10)

Marcellus Shale is saving small businesses, allowing folks to have “a nicer Christmas”: “Donald Lockhart sees a big difference over the last two years at his restaurant and gas station in South Montrose along Route 29, a major artery for drilling-related traffic. “We’ve better than tripled our business since last year,” Lockhart said as he sat in a booth in the dining area while a flatbed truck hauling an industrial generator idled outside. “I’m selling more Tastykake than they are in the grocery store.” … “They saved my business by coming here.” … Dozens of small businesses in the Endless Mountains region benefit from gas development, Mostoller said. … “My employees live better because they work in this industry,” Mostoller said. “There were a lot of people around here who had a nicer Christmas last year because of the gas business,” Lockhart said. (Towanda Daily-Review, 6/23/10)

The game-changing resource of the decade: “The extraction of shale natural gas is set to become a major growth industry in the United States. Recently, Amy Myers Jaffa wrote in the Wall Street Journal that natural gas could become “the game-changing resource of the decade.” Already Pennsylvania, West Virginia, Louisiana, and other states are beginning to reap the economic benefits of a natural gas boom. A study by Penn State University predicted that the natural gas industry in Pennsylvania alone will be responsible for the creation of 111,000 jobs and for bringing in an additional $987 million in tax revenue to the state by 2011. Natural gas extraction has been one of few industries growing (without government subsidies) during this recession. (Biggovernment.com Op-Ed, 6/23/10)

Copyright: Marcelluscoalition.org

Severance-tax issue a big hurdle for drill laws

Legislators want adequate tax share for municipalities fiscally hit by gas drilling.

STEVE MOCARSKY smocarsky@timesleader.com

Much legislation has been written recently to address concerns about natural gas drilling into Pennsylvania’s Marcellus Shale, but little has been signed into law.

And one issue, it seems has been overshadowing and holding up action on all the others: a state severance tax on natural gas extraction.

Several bills addressing a severance tax have been put forward by state legislators, and Gov. Ed Rendell also has proposed implementing such a tax.

“The biggest concern for legislators is that an adequate portion of a severance tax would come back to local governments that are financially impacted by drilling activities,” said Adam Pankake, representing Sen. Gene Yaw, a Republican from Lycoming County and one of the few legislators to have a Marcellus-related bill he sponsored signed into law.

Senate Bill 325, sponsored by Rep. Anthony Melio, D-Levittown, didn’t muster much support in the House because it authorized an 8-percent severance tax, all of which would go to the state’s General Fund, Pankake said.

State Sen. Raphael Musto, D-Pittston Township, proposed a severance tax plan in Senate Bill 905 that mirrors Rendell’s plan, directing all proceeds of a 5-percent tax and a 4.7-cent charge on every 1,000 cubic feet of gas extracted into the General Fund.

A bill by state Rep. Bud George, chairman of the House Environmental Resources and Energy Committee, would send only 60 percent of a 5-percent tax to the General Fund.

The remainder would be divvied up, sending 15 percent to the Environmental Stewardship Fund; 9 percent split evenly between counties and municipalities in which wells are drilled; 5 percent to the Liquid Fuels Tax Fund; 4 percent split evenly between the Game and Fish and Boat commissions; 4 percent to the Hazardous Sites Cleanup Fund; and 3 percent to a program to help low-income residents with heating bills.

A bill sponsored by Sen. Andrew Dinniman, D-West Chester, would send half of a 5-percent severance tax to the General Fund. Another 44 percent would be split evenly between the Environmental Stewardship Fund and municipalities in which a well was drilled; the remaining 6 percent would be split between the Game and Fish and Boat commissions.

Legislators are also considering severance tax models used in other states, such as a phase-in approach used in Arkansas, Pankake said.

Marcellus-drilling industry advocates describe it as a fledgling industry that a severance tax could cripple because of the financial resources needed to build a pipeline infrastructure where none previously existed.

Matthew Maciorski, spokesman for state Rep. George, D-Clearfield County, said severance tax legislative proposals have been “coming in fast and furious. Everyone has their own take on how the revenue should be divided.”

Maciorski said Marcellus Shale issues are “very complicated and integral to the whole budget debate.”

Some legislators use some pieces of legislation as bargaining chips in negotiations with the gas industry. For example, the industry doesn’t support a severance tax, but the industry is pushing for a law authorizing forced pooling – compelling landowners who don’t wish to lease their mineral rights to be part of a drilling unit with others that do.

“Sometimes there are alliances that have to be built. &hellip Sometimes we rely on members to tell us when it’s time to strike. It gets complicated going between the House and the Senate. Members want to have all their ducks in a row to prevent there being (additional delays) in the process,” Maciorski said.

Bob Kassoway, director of the House Finance Committee for the Democratic Caucus, said any severance tax bill will likely be passed as part of the 2010-11 state budget, and it’s likely that little if any other Marcellus-related legislation will be passed until that happens.

Sen. Yaw was pleased that Act 15 was signed into law on March 22. Based on his Senate Bill 297, it repeals five-year confidentiality for gas production financial records and requires well operators to submit semi-annual reports to the state. It also requires the state Department of Environmental Protection to post well data online.

But while the debate continues over the severance tax, legislation on issues important to lease holders, to residents with environmental concerns and to members of the gas industry continue to languish in the House or Senate or their committees.

In addition to severance tax legislation, there are at least four Marcellus-related Senate bills and at least 17 House bills pending.

For example, legislators are holding off a vote on Rep. Bill DeWeese’s House Bill 10, which would enable counties to assess value to gas and oil for taxation purposes, likely because it hasn’t been decided what – if any – percentage of a severance tax will go to counties.

Introduced 16 months ago, House Bill 297 remains in the House Transportation Committee. Sponsored by Rep. Mark Longietti, D-Hermitage, it would require the state Department of Transportation to publish by the end of the year a revised schedule of bonding amounts for roads damaged by heavy truck traffic and to update the amount at least every three years.

PennDOT last revised the schedule in 1978, Longietti said, leaving officials in municipalities damaged by drilling trucks with insufficient guaranteed funding to repair their roads.

Rep. George’s House Bill 2213, which increases bonding amounts for wells, boosts the number of required well inspections by DEP and adds protections for water supplies, has gained much local support. But after an amendment in the House Environmental Resources and Energy Committee in May, it was re-committed to the House Appropriations Committee.

Sen. Lisa Baker, R-Lehman Township, announced in May she is working on a series of bills to provide additional protections to drinking water sources that could be harmed by drilling.

State Rep. Karen Boback, R-Harveys Lake, issued a statement last week stating that she also was working to develop legislation to protect drinking water from gas drilling practices.

Painfully aware of the slow legislative pace in Harrisburg, Boback is urging the governor to issue an executive order implementing additional protective rules before more well-drilling permits can be issued.

Copyright: Times Leader

Drilling in shale bringing little tax

State county commissioners association is working to broaden taxing authority.

By Steve Mocarskysmocarsky@timesleader.com

Staff Writer

Counties, municipalities and school districts aren’t seeing any significant tax revenue related to Marcellus Shale development under current tax law.

But the County Commissioners Association of Pennsylvania is working to change that, lobbying for legislation that would give those governmental bodies property taxing authority on natural gas similar to taxes levied on coal extraction.

“We have to have the assessment law changed. The reason (is that) other minerals are assessed. It’s not fair to the other mineral (extraction companies) and it’s not fair to the rest of the taxpayers who have to pick up the burden of their exemption,” association Executive Director Douglas Hill said of natural gas and oil companies.

Hill said the state Supreme Court in 2002 ruled that counties had no statutory authority to tax oil and gas because state assessment law specifically includes coal but makes no mention of oil or gas.

Since that time, oil and gas interests have been escaping local property taxes, which had been paid in oil and gas-producing counties since at least the early 1900s, according to a position paper released by the association.

“Producers of other minerals such as coal and limestone already pay their fair share of the property tax. Counties support reversing the Supreme Court’s 2002 decision to assure that oil and gas companies contribute their share to the local tax base as well,” the paper states.

Hill said House Bill 10 of 2009, sponsored by state Rep. Bill DeWeese, D-Greene County, would restore property tax assessment authority on oil and gas.

The levy proposed in the bill would apply only to proven wells. “If there’s nothing to be extracted or (the gas) can’t be extracted, then there is no value,” Hill said.

Hill said there is, of course, opposition to the bill from the oil and gas industry. But he pointed out that other oil and gas producing states assess oil and gas extraction. Hill also said that large, multinational companies involved in Marcellus Shale exploration already had payment of such a tax built into their business plans and were surprised to learn that Pennsylvania counties can’t assess natural gas extraction.

Another association position paper points out several ways local communities are impacted by Marcellus Shale exploration that justify taxation.

“Some of the most visible impacts have been to township roads, county bridges and other infrastructure as developers bring drilling rigs, construction equipment and truckloads of water to and from drilling sites. &hellip Hotels might be filled with workers associated with Marcellus, impacting both the tourism industry and the county hotel tax,” according to the paper.

“Workers from out of state and their families have utilized social services such as drug and alcohol treatment and children and youth services. County jails, county probation and law enforcement have been affected. Even county recorder of deeds offices are affected, flooded by title searchers confirming ownership of subsurface rights,” the paper states.

House Bill 10 is still in the House Finance Committee for consideration.

“We’ve been working on getting agreement to move on it. We want to have things in place for a vote in the House and prepare for going to the Senate. We’ve also been working on an introduction of a bill in the senate,” Hill said.

Generally, legislators understand the issue, Hill said, but it “gets confusing at times because they are looking at a state severance tax,” and the county and local taxation issue “gets tied up in all the other issues related to the Marcellus,” he said.

Currently, there are at least five Senate bills and at least 17 House bills pertaining to Marcellus Shale exploration as well as one House bill, two senate bills and a budget proposal from Gov. Ed Rendell that address the imposition of a severance tax, according to information provided by state Sen. Lisa Baker, R-Lehman Township.

In the meantime, county assessors are waiting for some legislative determinations.

Luzerne County Assessor’s Office Director Tony Alu feels pretty confident that legislation eventually will be adopted and that the county will see some tax revenue from natural gas extraction.

Alu said assessors from various counties had been discussing among themselves various taxation formulas that would be most appropriate to tax natural gas extracted.

“We’re waiting on the state to make a determination so that we can all be uniform. &hellip We just want to make sure we’re doing the right thing,” Alu said.

Steve Mocarsky, a Times Leader staff writer, may be reached at 970-7311.

Copyright: Times Leader

Some urge suspension at forum on drilling

U.S. Senate candidate Joe Sestak holds a meeting at Misericordia University.

By Sherry Long slong@timesleader.com

Staff Writer

Published on June 13, 2010

DALLAS TWP. – Property owners concerned about the effects of Marcellus Shale drilling on water reservoirs made their views clearly known Saturday afternoon during a packed town hall meeting at Misericordia University’s library.

They wanted a moratorium enacted immediately on all gas drilling throughout the state until more is known on how to safely drill natural gas wells without using dangerous chemicals in the hydrofracturing process. The process uses between 1 million to 1.5 million of gallons of water per well laced with chemicals and dirt under high pressure to force the ground open to release natural gas, geologist Patrick Considine said.

Considine and Democratic U.S. Senate candidate Joe Sestak, whose campaign organized the town hall forum, said that during President George W. Bush’s administration, requirements on oil and gas companies were dramatically lifted. Considine, president of Considine Associates and forum panel member, explained that federal and state officials are not entitled to know what mixtures of chemicals each gas drilling company uses because it is considered a trade secret formula.

He warned that the federal and state governments need more officials to oversee the drilling processes, so the companies are not tempted to cut corners when disposing of the water after the fracking.

“Oil and gas companies need to be held to the same standards as other companies. We don’t need more regulations; we need to find ways to enforce the regulations we have,” Considine said.

People wanting the moratorium drowned out the drilling supporters, including business owner, economist and farmer Joe Grace of Morris in Lycoming County, who sees this industry being one of the biggest Pennsylvania has ever experienced by bringing 88,000 jobs to the state just this year and generating millions in revenue.

Worried about the environment and safety of area water systems, local podiatrist Dr. Thomas Jiunta adamantly disagreed with Grace, pointing to the recent gas well drilling incident in Clearfield County and a gas pipeline accident that killed one worker in Texas.

“This is not a safe activity as we know how to do it right now. We need to stop it first. We are putting the cart before the horse when you are talking about economic boom. You can’t drink gas,” said Jiunta of Dallas, a Gas Drilling Awareness Coalition founding member.

Jiunta added more focus should be put jobs that will support and grow green and renewable energy sources.

Sestak told people he sees gas drilling as an economic boon to the state, yet it needs to be done in a responsible way.

“I think this would be a good way to yes, exploit our resources, but not our communities. Business has to pause. Harrisburg has to stop until we get it right,” Sestak said, adding that he supports enacting a 5 percent severance tax on the drilling companies. He said is in favor of a moratorium

No representatives from the campaign of Sestak’s opponent, former U.S. rep. Pat Toomey, attended the forum.

A statement from the Republican candidate’s campaign staff said Sestak’s plan for taxing the drilling will backfire by pushing those companies to focus on other states.

“Marcellus Shale has the potential to provide Pennsylvania with over 200,000 new jobs and millions of dollars in added revenue, but Joe Sestak’s plan to tax natural gas extraction will chase these jobs out of Pennsylvania. A recent study warned that a tax on Marcellus natural gas output would very likely divert investment to other states like Colorado and Texas. This is further proof that Joe Sestak’s ‘more government, less jobs’ approach is bad for Pennsylvania,” Toomey’s Deputy Communications Director Kristin Anderson said.

State Rep. Karen Boback, R-Harveys Lake, did not attend the forum, but issued a statement Friday stating she was working to develop legislation to protect drinking water from gas drilling practices. Knowing that will take time to become law, she is urging Gov. Ed Rendell to issue an executive order implementing four additional rules before permits can be issued.

Her opponent, Richard Shermanski, a Democrat, attended the meeting, telling people he would not support any form of drilling if he knows it will damage water reservoirs.

Many attending the forum reside in Luzerne County, but some people, including Leslie Avakian of Greenfield Township in northern Lackawanna County, drove an hour to voice their views.

She believes the state’s Department of Environmental Protection needs to be spilt up into two separate agencies because DEP currently issues the permits and regulates the gas companies.

Lynn Hesscease of Dallas told her story of how she became deathly sick after three years of oil leaking in her cellar from a rusted pipe.

She explained how she can’t use any type of products made from petroleum – polyester clothing, petroleum jelly or use plastic cups.

“We have to be very careful it is not near our drinking water and we are not exposed to the chemicals or fumes because if we are, people will get sick,” Hesscease said.

Sherry Long, a Times Leader staff writer, may be reached at 829-7159.

Copyright: The Times Leader

Some urge suspension at forum on drilling

U.S. Senate candidate Joe Sestak holds a meeting at Misericordia University.

By Sherry Longslong@timesleader.com

Staff Writer

DALLAS TWP. – Property owners concerned about the effects of Marcellus Shale drilling on water reservoirs made their views clearly known Saturday afternoon during a packed town hall meeting at Misericordia University’s library.

They wanted a moratorium enacted immediately on all gas drilling throughout the state until more is known on how to safely drill natural gas wells without using dangerous chemicals in the hydrofracturing process. The process uses between 1 million to 1.5 million of gallons of water per well laced with chemicals and dirt under high pressure to force the ground open to release natural gas, geologist Patrick Considine said.

Considine and Democratic U.S. Senate candidate Joe Sestak, whose campaign organized the town hall forum, said that during President George W. Bush’s administration, requirements on oil and gas companies were dramatically lifted. Considine, president of Considine Associates and forum panel member, explained that federal and state officials are not entitled to know what mixtures of chemicals each gas drilling company uses because it is considered a trade secret formula.

He warned that the federal and state governments need more officials to oversee the drilling processes, so the companies are not tempted to cut corners when disposing of the water after the fracking.

“Oil and gas companies need to be held to the same standards as other companies. We don’t need more regulations; we need to find ways to enforce the regulations we have,” Considine said.

People wanting the moratorium drowned out the drilling supporters, including business owner, economist and farmer Joe Grace of Morris in Lycoming County, who sees this industry being one of the biggest Pennsylvania has ever experienced by bringing 88,000 jobs to the state just this year and generating millions in revenue.

Worried about the environment and safety of area water systems, local podiatrist Dr. Thomas Jiunta adamantly disagreed with Grace, pointing to the recent gas well drilling incident in Clearfield County and a gas pipeline accident that killed one worker in Texas.

“This is not a safe activity as we know how to do it right now. We need to stop it first. We are putting the cart before the horse when you are talking about economic boom. You can’t drink gas,” said Jiunta of Dallas, a Gas Drilling Awareness Coalition founding member.

Jiunta added more focus should be put jobs that will support and grow green and renewable energy sources.

Sestak told people he sees gas drilling as an economic boon to the state, yet it needs to be done in a responsible way.

“I think this would be a good way to yes, exploit our resources, but not our communities. Business has to pause. Harrisburg has to stop until we get it right,” Sestak said, adding that he supports enacting a 5 percent severance tax on the drilling companies. He said is in favor of a moratorium

No representatives from the campaign of Sestak’s opponent, former U.S. rep. Pat Toomey, attended the forum.

A statement from the Republican candidate’s campaign staff said Sestak’s plan for taxing the drilling will backfire by pushing those companies to focus on other states.

“Marcellus Shale has the potential to provide Pennsylvania with over 200,000 new jobs and millions of dollars in added revenue, but Joe Sestak’s plan to tax natural gas extraction will chase these jobs out of Pennsylvania. A recent study warned that a tax on Marcellus natural gas output would very likely divert investment to other states like Colorado and Texas. This is further proof that Joe Sestak’s ‘more government, less jobs’ approach is bad for Pennsylvania,” Toomey’s Deputy Communications Director Kristin Anderson said.

State Rep. Karen Boback, R-Harveys Lake, did not attend the forum, but issued a statement Friday stating she was working to develop legislation to protect drinking water from gas drilling practices. Knowing that will take time to become law, she is urging Gov. Ed Rendell to issue an executive order implementing four additional rules before permits can be issued.

Her opponent, Richard Shermanski, a Democrat, attended the meeting, telling people he would not support any form of drilling if he knows it will damage water reservoirs.

Many attending the forum reside in Luzerne County, but some people, including Leslie Avakian of Greenfield Township in northern Lackawanna County, drove an hour to voice their views.

She believes the state’s Department of Environmental Protection needs to be spilt up into two separate agencies because DEP currently issues the permits and regulates the gas companies.

Lynn Hesscease of Dallas told her story of how she became deathly sick after three years of oil leaking in her cellar from a rusted pipe.

She explained how she can’t use any type of products made from petroleum – polyester clothing, petroleum jelly or use plastic cups.

“We have to be very careful it is not near our drinking water and we are not exposed to the chemicals or fumes because if we are, people will get sick,” Hesscease said.

Sherry Long, a Times Leader staff writer, may be reached at 829-7159.

Copyright: Times Leader

Drill results could hike land values

EnCana is currently signing standard leases giving Luzerne County landowners $2,500-per-acre bonuses.

STEVE MOCARSKY smocarsky@timesleader.com

The value of land leases with natural gas drilling companies has been climbing in counties to the north, but whether that happens in Luzerne County will depend on the results of exploratory drilling scheduled to begin this summer.

Natural gas exploration companies are now offering leases in Susquehanna and Bradford counties with up-front per-acre bonuses in the $5,000 to $6,000 range and royalties as high as 20 percent, said Garry Taroli, an attorney with Rosenn Jenkins & Greenwald representing area landowners.

Late last month, natural gas producer Williams Companies bought drilling rights to 42,000 net acres in Susquehanna County from Alta Resources for $501 million, placing the lease value on that land at nearly $12,000 per acre.

So people like Edward Buda, who owns land in Fairmount Township on which the first natural gas well in Luzerne County will be drilled in July, might be feeling some lessor’s remorse, given that they agreed to comparatively paltry up-front bonuses for the first two years of the lease term.

When Buda, 75, of Ross Township and his late brother and sister-in-law were in negotiations with WhitMar Exploration Co. early last year, they, like many others, agreed to bonus payments of $12.50 per acre each year for the first two years of the lease. The bonus increases to $2,500 for the third year.

However, if drilling begins on or under a landowner’s property before an anniversary date of the lease, any bonus payments for subsequent years become null and void and the royalty provision of the lease kicks in. So, if the drilling that is to begin next month on Buda’s property is successful, he likely won’t ever see that $2,500-per-acre bonus but will receive much larger royalty payments.

Since Buda’s lease was negotiated, WhitMar sold most of the company’s interest in the leases to EnCana Oil & Gas (USA) Inc.

EnCana is currently signing standard leases giving Luzerne County landowners $2,500-per-acre bonuses – $1,000 the first year of the lease and $1,500 the second year, according to EnCana’s Group Lead for Land (New Ventures) Kit Akers.

Some landowners who signed the same type of deal with WhitMar as Buda believe they’ve been treated fairly.

Michael Giamber, 57, of Fairmount Township, lives about 2 miles from the Buda drill pad. While the Budas negotiated their lease on their own, Giamber joined a consortium of landowners who negotiated a deal with WhitMar in 2008 for bonuses of $12.50 per acre each year for the first two years of the lease, $2,500 per acre for the third year, and a 20-percent royalty on all gas produced.

“It was in the middle of a recession and leasing had pretty much stopped except in Dimock. We essentially partnered with WhitMar,” Giamber said.

In exchange for landowners accepting the initially small incremental bonus payment arrangement, WhitMar promised to do seismic testing of the leased land and partner with a company that would handle the drilling and secure permits for one to three exploratory wells in the county within two years.

“I signed on not because of the bonus, but because of the 20-percent royalty and because if they did not drill one to three wells after two years, we’d be free agents again,” able to renegotiate for better terms, Giamber said. “Because we were in a recession, what did we have to lose?”

“A lot of older people would rather more up-front money, and I can appreciate their position,” Giamber said.

Jeffrey Nepa, an attorney with Nepa & McGraw in Carbondale and Clifford, believes people who signed leases early for smaller bonuses were either “more desperate and needed money or were misinformed about what the extent of (drilling in the Marcellus Shale) was. Some people have had buyer’s remorse, so to speak, regretful that they signed and wanting to get out,” Nepa said.

Nepa said he’s seen bonus money increase, dip back down, “and now it’s creeping back up again. And it appears that landowners “who held out, so to speak, are the ones that are rewarded with the largest contracts. In the Barnett Shale (in Texas), I’ve heard of property owners getting in excess of $20,000 per acre, and they were the ones who held out.”

Gas companies normally drill in 640-acre blocks of land. So people with a larger tract of land are better off holding out for better lease terms, Nepa said.

On the other hand, those who signed leases earlier are now the ones who will see royalty payments kick in much sooner than anyone else, because they will be the first to have wells drilled, said Robert Schneider, 39, of Fleetville, Lackawanna County.

Schneider joined a landowner consortium that negotiated leases with a $2,100 bonus and an 18-percent royalty in 2008 with Exco Resources, and he’s glad he didn’t hold out for more.

“Two years have gone by and I have three years left. … There’s a risk if you wait,” Schneider said, speculating that implementation of more rigorous and costly government permitting requirements, the establishment of a severance tax or finding insufficient or no gas in his area are all reasons that companies might pull out and stop leasing.

EnCana’s Akers backed up what Giamber and Schneider had to say. “People who leased earlier put themselves in a position to most likely have their land drilled earlier,” she said.

And Akers said, if WhitMar had not been able to secure leases at relatively low cost to the company, exploration in Luzerne County might not have begun as soon as it has.

“Because these people leased early to WhitMar, WhitMar was able to build a large position of leases that allowed for horizontal drilling. That’s what got a company like EnCana interested in coming to Luzerne County. If we had not seen a consolidated lease position, it’s unlikely WhitMar would have gotten a company like EnCana to come in … It was possible that the $12.50 offer was the only offer those people would ever get,” she said.

Akers also believes that the reason landowners in Susquehanna and Bradford counties are being offered much higher bonuses is because hundreds of wells have been drilled there and natural gas extraction has proven successful.

“Luzerne County, on the other hand, is really on the frontier. There’s no way to know if shale within a geographic region will produce any gas or enough gas to make drilling profitable without actually drilling wells. There have been no wells drilled in Luzerne County, so that’s the reason why there’s a difference in lease prices between Luzerne County and other counties,” Akers said.

If wells on Buda’s land and a site in Lake Township don’t produce any gas or at least enough of it to make drilling there worthwhile, land lease values in Luzerne County could drop to zero, Akers said.

If the wells do produce significant amounts of gas, however, competition for drilling rights will definitely heat up, Akers said, and with it the price.

Steve Mocarsky, a Times Leader staff writer, may be reached at 970-7311.

Copyright: Times Leader